Getting started

If you’re new to BCU Bank you can easily open an account online in a matter of minutes.

You’ll need to:

- be at least 18 years old

- have a current Australian driver’s licence or Australian passport document

- have access to your mobile phone with a camera

You can open most of our everyday and savings accounts online, and from there you'll also be able to open a term deposit from internet banking or the mobile app.

If you already bank with us – great choice! You can open most deposit accounts in your name online by going to ‘Apply’ in internet banking or ‘Open account’ in the mobile app.

To have your salary credited to your BCU Bank account, you simply need to give your BSB number and account number to your employer or payroll officer.

Your account will need to be an everyday transaction account or savings account to receive your pay directly.

Whether you're a new customer or already bank with us, you can open a new account online in minutes.

You should receive your physical Visa Debit card by mail within 7-10 business days.

If you've recently opened a new account online, you can set up your digital card straight away and use it with the digital wallet on your smartphone.

Switching has never been easier – you can open a new account with BCU Bank online in just a few minutes.

We can guide you through the the steps to open your account, set up new payment arrangements with your new account or card and provide tips for a smooth changeover.

If you're new to BCU Bank you'll need to have at least one (1) photo identity document to open your account with us.

You can use either:

- Australian driver licence

- Australian passport

Open your account online

If you’re opening your account online, you’ll need to have access to your mobile phone with a camera so that we can verify your identity.

Don't have your photo ID?

If you're under 18, not an Australian citizen or simply don't have an Australian photo identity document, you can use a combination of primary and secondary documents to open your account at one of our branches.

If you are experiencing issues when opening your account online as a new customer, please try the following troubleshooting tips:

- Check the information that has been scanned carefully to ensure all your details are correct and exactly match your document before submitting.

- Make sure that your identity document is clear & readable – not too close or too far away. Some documents are very faded or have marks obstructing the information.

- Make sure that your identity document, its data and your photo is not obstructed in any way.

- When taking your selfie, remember to remove any headwear such as earphones, hats or sunglasses.

- Be aware of lighting affecting the photo quality. You can try using a different location or background to improve image quality.

- You can try using a different identity document.

Please call us on 1300 228 228 if you require further support.

If you're under 18, not an Australian citizen, or simply don’t have an Australian photo identity document, you can still open an account by visiting one of our branches and providing a combination of primary and secondary identification documents.

We will need you to provide:

- one primary document, and

- one secondary document

Primary documents with a photograph

- Australian passport (current, or expired within the last two years)

- Current foreign passport

- Current Australian driver licence

- Proof of age card (issued by an Australian State or Territory)

- Current Australian ImmiCard

Primary documents without a photograph

- Australian birth certificate or birth extract

- Foreign birth certificate

- Australian citizenship certificate

Secondary documents

- Current Centrelink card

- Letter or notice from the Australian Taxation Office (less than 12 months old)

- Letter or notice from a local government or utility provider (less than 12 months old)

Additional ID options for children under 18

If the child does not have photo ID, we can also accept the following (in addition to the child's birth certificate):

- Letter from a school principal – must be issued within the last 3 months and confirm the child’s full name and date of birth

- Current student ID card – must include the child’s full name, photo, and date of birth

We accept either original documents or certified copies. If you're unsure what documents you need to bring, feel free to get in touch – we’re happy to help.

If you’re unable to provide a birth certificate, we accept other official documents that show you're the legal guardian or adoptive parent of a child. Accepted documents include:

- Guardianship order – This is typically issued following a court decision, and names you as the child’s legal guardian.

- Adoption order or certificate – Issued by a State or Territory authority, this confirms you’re the adoptive parent with the same legal rights as a birth parent.

Please make sure the document clearly shows both your name and the child’s name. If you're not sure whether your document meets these requirements, feel free to get in touch and we’ll be happy to help.

New customers

You can also open your new joint account at your local branch.

You'll both need to confirm your identity using one (1) of the following identity documents:

- Australian driver's licence

- Australian passport

Remember to have your Tax File Numbers handy if you want to avoid being charged general withholding tax on any interest you earn over a certain threshold.

Find out what other identification documents you can use to open an account.

Existing customers

If you both already bank with us then you can open your joint account by calling 1300 228 228, or by visiting your local branch.

If you'd like to set up your account so that both account holders need to jointly approve transactions, you'll need to visit us in branch to sign an Authority to Operate Form.

Find out what other identification documents you can use to open an account.

To access our digital banking services, you’ll first need to register for internet banking.

- If you joined BCU Bank online, you'll already be registered and should have received your password.

- If you joined in-branch, you can register there with the help of the team. Alternatively, a quick call to our team on 1300 228 228 can get you registered.

Once registered, you can log in to internet banking from the website, or download the BCU Bank app from the app store. Use your internet banking credentials to log in.

You can easily register a PayID in internet banking or the mobile app.

A PayID is a unique identifier – either a mobile phone number or email address – linked to your account. It allows you to receive instant and secure payments directly to your account, without needing a BSB and account number.

To register a PayID:

- In internet banking: Go to Accounts > Register PayID and follow the prompts

- In the mobile app: Go to Pay > Manage PayID and follow the prompts

To link an available PayID to your account:

- Select the account you'd like to connect to the PayID.

- Choose the account name from the options provided.

- Review and accept the terms and conditions.

- Enter the secure code sent to your PayID to validate ownership.

Note: If you’re setting up a PayID using an email address, the code will be sent to that email, not via SMS.

If the PayID you entered is unavailable or already in use, you’ll be notified. You can dispute ownership by clicking Dispute.

You can personalise the name that appears for each of your accounts in the mobile app and internet banking. This can be helpful when saving for different goals or managing accounts for specific purposes (e.g. house deposit, new car, takeaway fund).

In the mobile app: Select the account you want to personalise, tap the three dots in the top-right corner, then choose Rename account > Personalised account name > Update.

In internet banking: Go to Settings > Account preferences > Preferred account name > Update and save.

You can change or remove your personalised account name any time. To revert to the original name, just delete the custom name and save your changes.

Everyday & savings accounts

The interest on a savings accounts is calculated on your daily balance and is credited to your account on the last day of every month. This means that every deposit you make throughout the month will earn interest from that day onwards.

Bonus interest, if applicable to your account, will also be calculated on your daily balance in line with the bonus interest conditions for your account.

Your interest summary can come in handy when you’re doing your tax return, applying for a loan, or just wanting to keep a closer eye on your finances.

It shows how much interest you’ve earned on your accounts or paid on your loans throughout the financial year – and it’s easy to view online anytime using internet banking or the mobile app.

We’ll also send your interest information to the Australian Tax Office (ATO).

Your annual interest earned will be reported directly to the ATO. It will appear in your myGov account shortly after the end of the financial year (30 June).

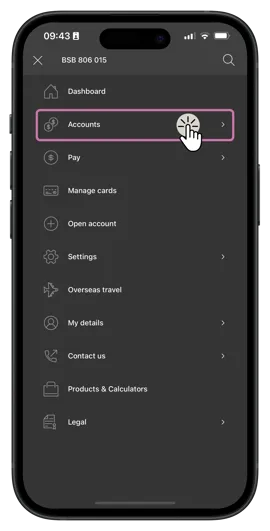

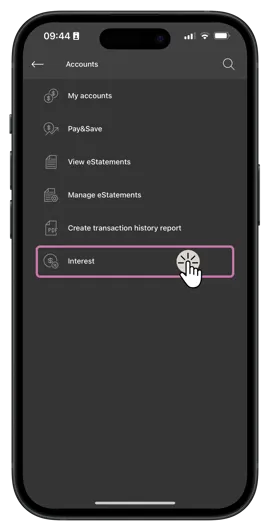

Using the mobile app

- Log in to the P&N Bank mobile app

- Tap Accounts in the main menu ( )

- Select Interest

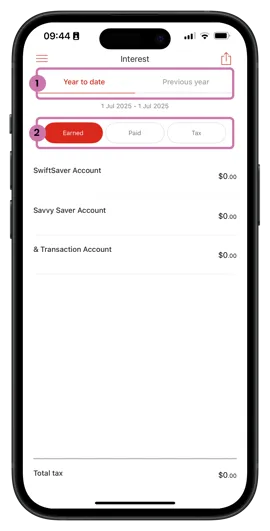

From here, you can switch between the current or previous financial year (1), and use the tabs to view the interest earned, paid, and any tax withheld on your accounts (2).

You can also view interest for individual accounts by selecting the account on the Accounts screen, tapping the three dots in the top right-hand corner, and selecting Account information.

Handy tip: If you need a copy for your records, just take a screenshot!

Don't have our mobile app yet?

Download it today – it’s the easiest way to manage your accounts on the go.

Using internet banking

- Log in to internet banking

- Go to Accounts in the main menu

- Select Interest details

You can switch between the current and previous financial year, and you’ll see an overview of any interest earned or paid, as well as any tax withheld on your accounts.

Want a PDF version? Click the printer icon, and in the destination dropdown, select Save as PDF.

You can find information about the fees and charges applicable to your BCU Bank account on our fees and charges pages:

These should be read in conjunction with the fees and charges specified for the product outlined on the product page in the relevant Terms and Conditions document.

You can make a cash or cheque deposit at most BCU branches. Some of our smaller branches do not handle cash, which will be listed in their branch services.

We accept bank cheques or a cheque drawn on another financial institution.

If you can't get to a branch you can also deposit cash and cheques at participating Post Offices using Bank@Post. Limits may apply.

If you have any queries about the branch services available at your local branch please call us on 1300 228 228.

If you deposit a cheque to your BCU Bank account, in most instances it will take four working days to clear, and the funds should be available on the fifth working day.

With the increase in popularity of digital payments and the move towards instant payments, we no longer issue cheque books for personal or business banking accounts.

Other payment options include online transfers to a BSB and account number or to a PayID. You can also pay bills using BPAY® or PayTo.

If you've been asked to pay for something by cheque, you can request a bank cheque by calling us on 1300 228 228.

Our Boss Saver can be linked to an Access Account held in your name as a single account holder only. You cannot link to an Access Account held in joint names.

Please visit a branch or contact us on 1300 228 228 if you would like to open an Access Account in your name.

When the 4 month bonus interest term of your Bonus Saver Account ends, you will continue to earn interest at the standard variable rate.

You can open a new savings account online at any time in internet banking or via the BCU Bank app.

Once the account holder turns 13, the Scoot Super Saver account will be automatically converted to an Access Account. This account will be in the child’s name and will continue to have the parent or guardian as a signatory.

Term deposits

You can open a BCU Bank term deposit with just $1,000 and invest up to $1 million.

Up to $250,000 of your total deposit is protected by the government’s Financial Claims Scheme.

You can add money to your Term Deposit on the day you open the account, or when it matures if you choose to roll over your investment.

You can manage your maturity instructions, including adding new funds to the account in internet banking or the mobile app.

If you already have a transaction or savings account with us, you can log in to internet banking or the BCU Bank mobile app and open up a Standard Term Deposit online in a matter of minutes.

To open a Regular Income Term Deposit or a term deposit for over 55s, you can contact us via secure mail, call us on 1300 228 228 or visit your nearest branch.

New customer?

If you’re new to BCU Bank, you can easily open a transaction or savings account online to receive your funds, which is quick and easy. Once your funds have landed in your account, you can open a term deposit using internet banking or the BCU Bank mobile app.

You can close your term deposit account early at any time, but doing so will likely affect the amount of interest you receive.

Further information is available in our Term Deposit Account Terms & Conditions.

At the time of opening your term deposit account, you set instructions for what you want us to do with your deposit and interest when it matures.

When your term deposit is due to mature you can explore your options to:

- add some funds to your term deposit,

- transfer funds to another nominated account,

- renew your term deposit for a new term,

- change your interest payment instructions, or

- a combination of these options.

You can also choose to leave your money – and the interest you've earned – in the same term deposit (it’s what we call a rollover).

Your instructions can be provided any time up to your term deposit maturity date, or within the seven-day grace period following the account maturity.

View the Term Deposit Account Terms & Conditions for more information about rollovers.

Account access

If you have misplaced your card or left it somewhere by mistake you can easily place a temporary lock on your card while you look for it.

The temporary lock can be applied in internet banking or the mobile app and will restrict all transactions on your card. This does not include regular recurring withdrawals such as direct debits or digital wallet transactions made using your mobile phone.

To put a temporary lock on your card in internet banking or the mobile app, go to Manage Cards.

Permanently lost your card?

You can report your card as lost or stolen and reorder a new card using our digital channels, or by calling us on 1300 228 228 during business hours. To report a card as lost or stolen or report card outside of business hours call 1800 648 027 .

To report your card lost or stolen using internet banking or the mobile app, log in and go to Manage Cards. Select the card you need to report as lost or stolen and then follow the prompts to cancel your card and order a new one.

If you need any help please call us or visit your local branch and we'll be happy to help.

You can send money to another Australian bank or financial institution in Australia using the Pay someone function in internet banking or the BCU Bank app.

From the main menu, go to Transfer/Pay > Pay someone. You can send money to:

- A saved payee (someone you've paid before and saved their details)

- A new payee, using a BSB and account number

- A new payee, using a PayID

- Another BCU Bank account, using a PayID or BSB and account number

Information about each additional field:

- Payee nickname (optional): Tick 'Add to Favourites' to save the payee’s details for future use.

- Description: Add a note to help you identify the payment on your statement.

- Reference (optional): This will appear on the payee’s statement.

Using saved payees:

To transfer money to a saved payee, just select their name from your favourite payees list. You can sort the list by payee name, account name, or last payment date, or search for a payee by clicking the search icon in the top right corner.

Remember, transfers between different financial institutions can take up to 48 business hours. However, if the receiving bank accepts Osko payments, your funds could be sent and received in minutes.

Your daily ATM withdrawal limit is $1,000.

To increase your limit, please call 1300 228 228 or visit your local branch and one of our friendly team will be happy to assist.

Please note, limits can only be increased for 24 hours and then will revert back to the standard amount.

To help protect your funds, BCU Bank applies daily transfer limits on digital banking.

When you first open your account, your daily limits for internet banking and the BCU Bank app are:

- $5,000 per day to another BCU Bank account

- $5,000 per day to an account at another bank

- $10,000 per day for BPAY payments

- For international payments, you'll need to register first and request your limit first

These limits are a combined daily total across all accounts within your membership.

Can I set lower daily transaction limits?

Yes – you can manage your limits in the transaction limits section of internet banking or the BCU Bank app. You can lower your daily limits to $2,000, $1,000, or even as low as $0.00, and adjust them yourself up to $5,000.

We recommend keeping your daily limits set at the minimum needed for your regular banking to reduce the risk of fraud. If we detect potential fraudulent activity, we may lower your limits without notice to help protect your account.

How do I change my digital banking transfer limit?To have an account in two or more names, you will need to apply for a new account together.

If you have an existing individual account, you can authorise another person to access and use your account. This is called an authority to operate, however the account ownership will remain unchanged in your name.

If you'd like more information about joint accounts, you can message us, call us on 1300 228 228 or visit your local branch, and one of our friendly team will be happy to assist.

You can close your BCU Bank account by contacting us in any of the following ways:

- Call during business hours on 1300 228 228, or +61 2 5646 5900 if you’re overseas.

- Send us a secure mail from internet banking or the BCU Bank app.

- Get in touch via webchat after logging into your internet banking, so that we can confirm your identity.

- Visit your local branch with your photo ID.

If the account requires two signatures to authorise transactions, we'll need to speak with both account holders before we can close your account.

And remember, before closing your account, make sure that all recurring payments and direct debits set up from the account are cancelled, and any overdrawn balance is cleared in full.

If you want to close your membership with BCU Bank in full you can download and complete the Resignation of Membership Form.