As the days start to get longer and warmer, it’s a popular time to dust off the cobwebs and give the house a thorough spring clean.

But what about your finances? Revisiting your financial goals to ensure you are heading in the right direction and checking in on your household budget is an important task.

Here are five financial spring-cleaning tips to help you to get on top of your finances:

1. Set realistic financial goals – and write them down

Research from the Dominican University of California* revealed that people who write down their goals are 42% more likely to reach them than those that don’t.

The research also showed that sharing your goals with another person can increase your chances of success.

What are you waiting for? Grab a pen and paper and get started!

If you find goal-setting difficult, try breaking it down into smaller pieces:

- Start with a long-term vision – think as big as you like. Imagine your ideal lifestyle, your home and what you would ideally spend your time doing.

- What are some of the smaller scale goals? For example, boosting your savings or clearing some debts. What would you like to achieve over the next month or year?

- What are the steps you need to take to achieve the smaller goals? For example, to save $1,000 in one year you’d need to put aside about $20 per week.

Keep your plan on hand and revisit it regularly so you can keep on top of your goals.

Make sure you tick off your small wins along the way – seeing what you’ve achieved is always good motivation.

2. Review your expenses

Going over your expenses with a fine-toothed comb is an important part of understanding where your hard-earned dollars are going.

Look out for unused subscriptions that no longer serve your needs and identify areas where you could you cut down.

If your bank account has fees, consider switching to a low or no fee bank account.

While living within your means is important, so is doing the things you love – such as going out for a nice meal. As Marie Kondo would say, assess whether something “sparks joy” for you or whether you should let it go and cut out unnecessary expenses.

3. Create a budget

Budgeting is not a one-size-fits-all exercise and the best type of budget is one you use and can stick to. If detailed spreadsheets aren’t for you try:

- Our free online budget planning tool

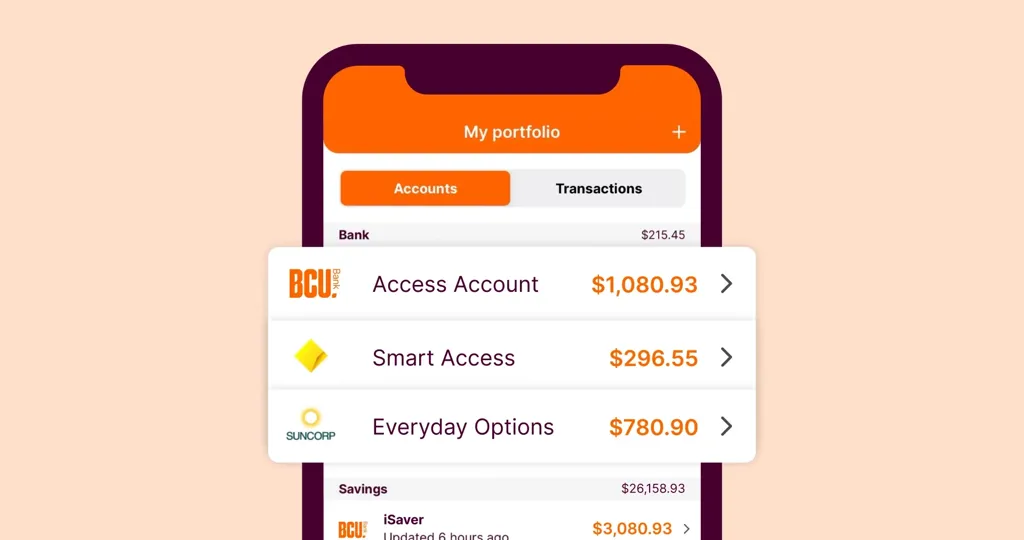

- An expense tracking app

- Good old pen and paper

4. Prepare for the unexpected

If 2020 taught us anything, it’s that the unexpected can happen. It is important to ensure that you have a “safety net” in place in case of any unforeseen circumstances, such as sudden job loss or illness.

This is a good subject to discuss in greater detail with a financial planner but here are two simple ways to get started:

- Put aside some “rainy day” savings – easily accessible funds you can draw on in an emergency.

- Check your insurance. It may be helpful to seek expert advice to ensure you have the right insurance for your circumstances and that you are adequately covered for life’s unexpected events.

5. If you have a home loan, make sure it's still working for you

A lot can change in a year, so take some time to review your home loan’s fees, interest rate and features.

You may find that that there are other home loans available that better meet your needs.

Find out how you can save money on your home loan.

*Dominican University of California