A safer way to pay is here. We’ve introduced Confirmation of Payee – a new feature that checks the account name you enter before you confirm a payment, helping keep your money safe. Learn more about safer payments.

Lock it, love it

Enjoy the certainty of repayments with home loans fixed from one to five years.

2 years fixed from

Fixed rate

Comparison rate**

Your finances, made easy

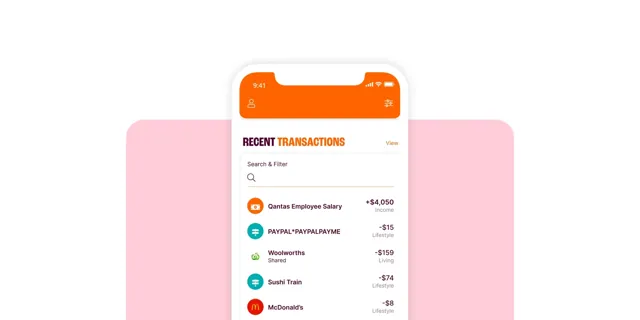

Budgeting app

Your personal financial assistant, with all of your accounts across all your financial institutions in one place.

Test your financial IQ

Understanding your finances is the first step to achieving your money goals. Discover your personal financial wellness score.

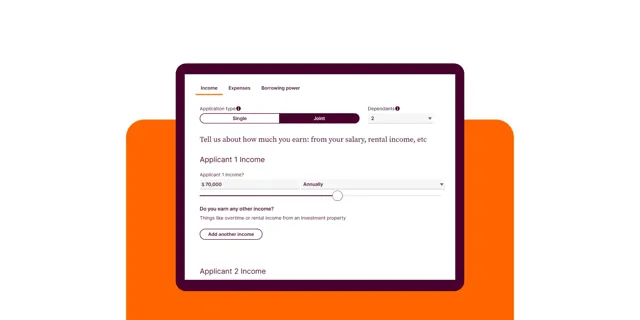

Calculators

A range of calculators you may find useful if you're looking to buy, refinance, review your spending habits, or estimate your savings.

Keeping you savvy

How to set yourself up for success in the new financial year

Purchasing a home solo

Tips for safe banking on a smart phone

Award-winning home loans

While it’s not all about the accolades, our home loans have been recognised with multiple awards for having flexible features, competitive rates, and quick approvals.

Have a look at our trophy case

Important information

Banking and Credit products issued by Police & Nurses Limited (BCU Bank).

Any information on this website is general in nature and does not consider your personal needs, objectives or financial situation. Our rates are current as of today and can change at any time. Credit eligibility criteria, terms and conditions, fees and charges apply.

*This offer is strictly limited to a maximum of $300 cashback per policy for any new Eligible Insurance Policy purchased, including joint policies and is only available for BCU Bank customers who meet the following conditions. Open to Australian Residents 18 and over. Offer applies to new Combined Home Building and Contents Insurance (‘Eligible Policies’) purchased through BCU Bank online, over the phone, or in branch, between 21 January 2026 – 28 April 2026 and starting in the same period. To be eligible for the offer the policy premium must be paid either in full, or at least one instalment for an Eligible Policy within 8 weeks. The primary policy holder must have an active BCU Bank transaction account at the time of cashback payment. The $300 cashback will be deposited into the customer’s transaction account within 40 days from the conclusion of the 8-week period.

**Comparison rate calculated on a loan amount of $150,000 over a term of 25 years based on monthly repayments. For variable Interest Only loans, comparison rates are based on an initial 3 year Interest Only period. For fixed Interest Only loans, comparison rates are based on an initial Interest Only period equal in length to the fixed period. During an Interest Only period, your Interest Only payments will not reduce your loan balance. This may mean you pay more interest over the life of the loan.

WARNING: This comparison rate applies only to the example or examples given. Different amounts and terms will result in different comparison rates. Costs such as redraw fees or early repayment fees, and cost savings such as fee waivers, are not included in the comparison rate but may influence the cost of the loan.