If you have financial aspirations, a solid budget is usually the first plan to help achieve your goals. Managing your money gives you more choice for the future and it pays to start as soon as possible.

Your budget doesn’t have to be all spreadsheets and formulas and calculators, here’s a simple method of better budgeting.

The 50/30/20 budgeting rule

A great place to starts is the 50/30/20 budget rule. With this rule you allocate:

- 50% to needs, such as rent or home loan repayments, transportation, your weekly shop, paying off debt, insurances and health costs, education and utility bills.

- 30% to wants, such as daily coffee, eating out, shopping, entertainment, hobbies, and holidays.

- 20% to savings, such as emergency funds, savings goals like a house deposit, additional debt repayments, as well as investments inside and outside of superannuation.

To show you how it works, let’s use two individuals, one receiving an after-tax income of $52,000 p.a. and the other receiving an after-tax income of $104,000 p.a. with the 50/30/20 budget calculator:

The 50/30/20 budget calculator

Scenario 1 - annual income $52,000

| Allocation | Expenditure (rounded to the nearest dollar) | |||

| What | Weekly | Fortnightly | Monthly* | Annually |

| 50% Needs | $500 | $1,000 | $2,167 | $26,000 |

| 30% Wants | $300 | $600 | $1,300 | $15,600 |

| 20% Savings | $200 | $400 | $867 | $10,400 |

| TOTAL | $1,000 | $2,000 | $4,334 | $52,000 |

Scenario 2 - annual income $104,000

| Allocation | Expenditure (rounded to the nearest dollar) | |||

| What | Weekly | Fortnightly | Monthly* | Annually |

| 50% Needs | $1,000 | $2,000 | $4,333 | $52,000 |

| 30% Wants | $600 | $1,200 | $2,600 | $31,200 |

| 20% Savings | $400 | $800 | $1,733 | $20,800 |

| TOTAL | $2,000 | $4,000 | $8,667 | $104,000 |

*Please note: As there are 52 weeks in a year, not 48 (i.e. four weeks x 12 months), the monthly expenditure has been calculated by multiplying the weekly expenditure by 4.334 (52 weeks / 12 months).

You can see how much is allocated to each category and how savings can grow over a year.

Things to consider

When creating a budget, there's lots of benefits, such as:

- Helping you understand what your current spending habits are and what changes are required to meet your savings goal.

- Making you more financially secure to better tackle unexpected costs and expenses.

- Giving yourself the confidence to spend money when you know that you can afford it.

Our budget calculator can help with your financial goals.

High income earners

For those with high incomes, a 50% and 30% allocation towards need and wants may be too high. Tweaking the savings percentage could enable you to live comfortably and reach savings goals even sooner.

Low to middle income earners

For those who live in expensive areas, or with slightly lower incomes, it may prove difficult to only spend 50% of your salary on rent and outgoings. You may need to decrease the percentages for wants or savings to enable a good lifestyle.

Moving forward

The 50/30/20 rule provides a great place to start for all you budgeting needs.

Once you’re in a routine of managing your money and looking to broaden your goals, such as building wealth or investing, it may be worthwhile to seek professional advice on your financial situation.

If your budgeting goals are a step towards buying your first home, check out our home loan borrowing power calculator or chat to a mobile lender.

You may also be interested in:

Budget like a boss in just 2 minutes per day

So, you want, or need, to improve your budget but don’t have the time to sit down and input every single purchase that you’ve made since payday?

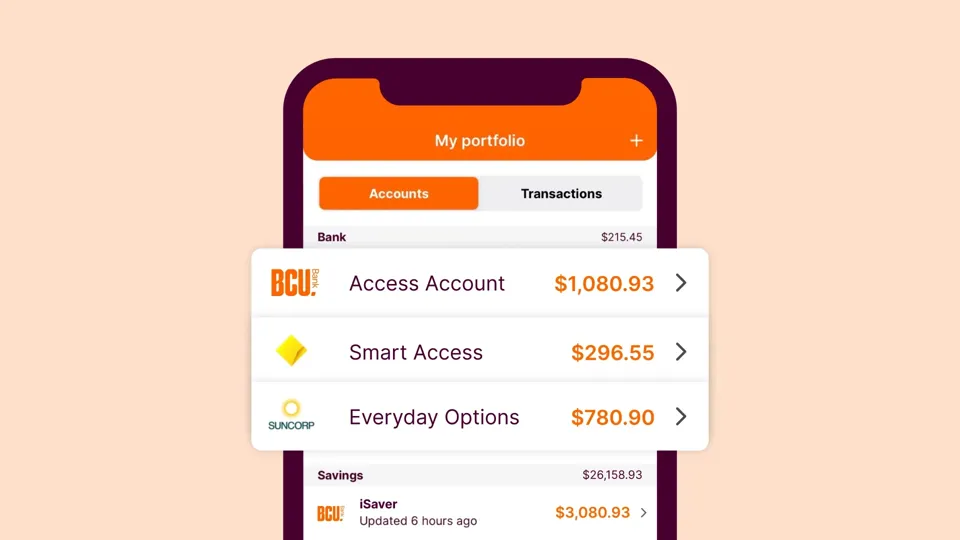

Budgeting app

Join us

Important information

Banking and Credit products issued by Police & Nurses Limited (BCU Bank).

Any advice does not take into account your objectives, financial situation or needs. Read the relevant terms and conditions, before downloading apps or acquiring any product, in considering and deciding whether it is right for you. The Target Market Determinations (TMDs) are available on our website or upon request.