Why choose an Offset Account?

The features don't stop there

- Your Mortgage Offset Saver works like a transaction account, so you can shop and pay bills while still saving on interest.

- Use your phone to make secure, contactless payments with Apple Pay, Google Pay™ or Samsung Pay – no wallet needed.

- Enjoy free cash withdrawals at all atmx and major bank ATMs across Australia, so your money’s always within reach.

- Stay in control by temporarily locking your card or blocking certain transaction types, straight from the app.

- Your money is safe – deposits up to $250,000 are protected by the Financial Claims Scheme.

What is an offset account?

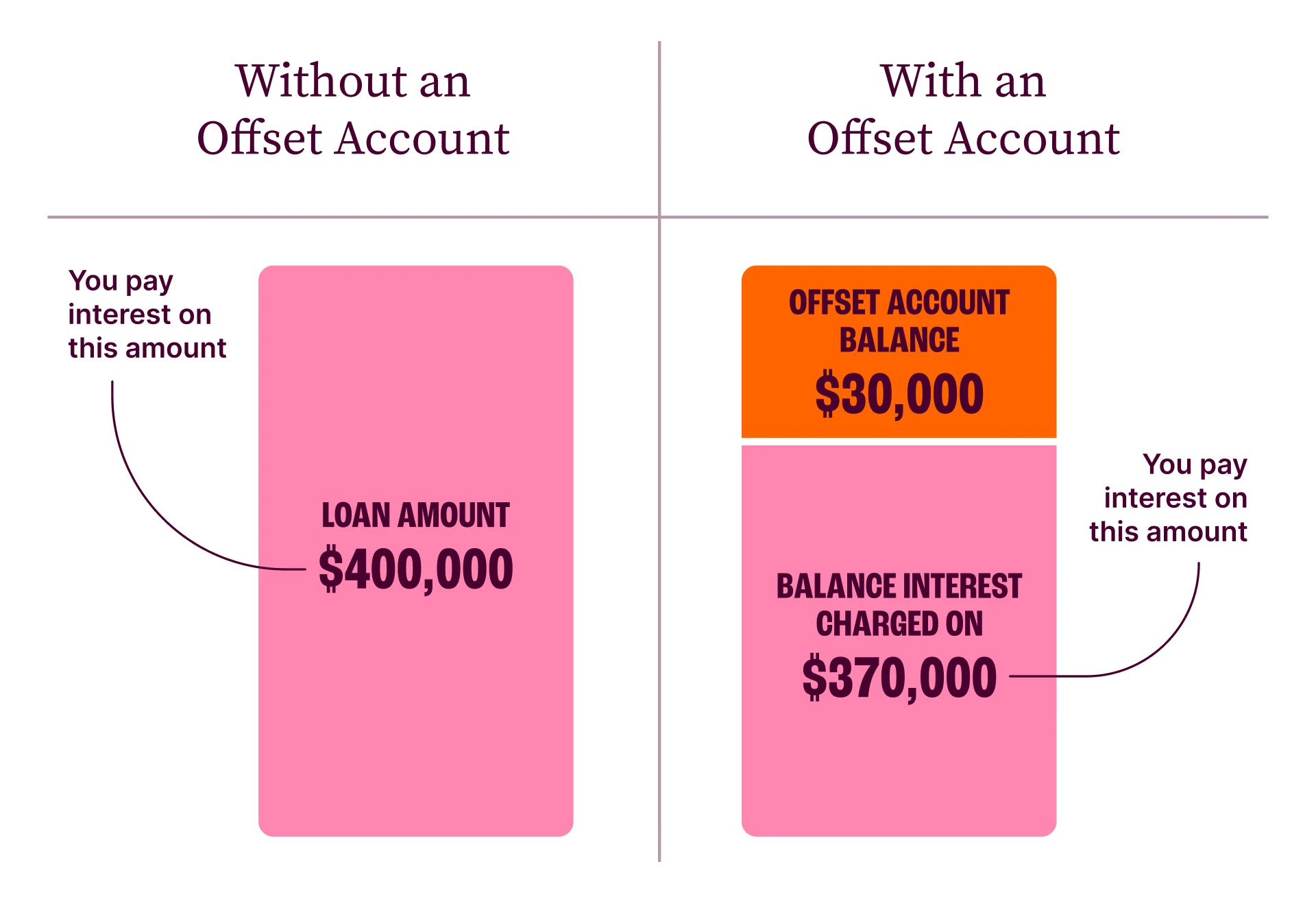

An offset account is a transaction account that’s linked to your home loan. The money in your offset account reduces the amount of interest you pay on an eligible home loan – because you’re only charged interest on the difference between your loan balance and the amount in your account.

For example, if you’ve got a $400,000 loan and $30,000 sitting in your offset account, the bank will only charge you interest on $370,000.

It's a clever way to make your money work harder – because the more you keep in your account, the more you could save over the life of your loan.

Don’t have a home loan with us?

Our Offset Home Loan could help you save more on interest.

rates and fees

Interest rates

This account doesn’t earn interest. Instead, your money helps you reduce the amount of interest you pay on your home loan.

Fees and charges

Our Mortgage Offset Saver has no monthly or standard transaction fees.

Other fees and charges that may apply can be found on our account fees and charges page.

How to open an offset account

Am I eligible to open an account?

To open this account, you’ll need to:

- Have an eligible BCU Bank home loan with an offset facility

- Be at least 18 years old

- Live in Australia with a current residential address

- Be applying as an individual (not a business or association)

What documents do I need to open an account?

Once you get in touch, a home lending specialist will let you know which documents you’ll need to open an Offset Account. If you’re not already banking with us, you’ll also need an Australian driver licence or valid passport to verify your identity.

If you don’t have an Australian driver licence or valid passport, find out what documents you can use to open an account.

Find your home loan match

Got a question about offset accounts?

With a home loan offset account every dollar in your account is offset against your variable rate home loan balance.

For example if you have $1,000 dollars in your offset account, this will reduce the balance that your interest is calculated on by $1,000 dollars. That’s $1,000 dollars you’re not paying interest on, so more of each repayment goes to paying off your loan rather than paying interest.

An offset account is not available on all home loans. Please check the loan product features or your loan contract to see if you are eligible for redraw.

An offset account is a bank account linked to your home loan. The balance in your account is used to offset the outstanding balance of your loan, which reduces the amount of interest you’re charged. You can use your offset account the same way you would a transaction account, so it’s a great option to deposit your salary and manage your everyday banking.

A redraw facility is a feature available on some variable rate home loans, and isn't a separate bank account. It allows you to withdraw any extra money you've paid towards your home loan over and above your minimum required repayments.

Both offset accounts and redraw facilities can help reduce the amount of interest you pay on your home loan, which could mean you pay your loan off sooner.

You can have one offset account per eligible home loan.

Because we're here to help

Important information

Banking and Credit products issued by Police & Nurses Limited (BCU Bank).

Any information on this website is general in nature and does not consider your personal needs, objectives or financial situation. Our rates are current as of today and can change at any time. Credit eligibility criteria, terms and conditions, fees and charges apply.

Read the relevant product terms and conditions before deciding if a product is right for you.

The Mortgage Offset Saver Account is only available to members who have an Offset Home Loan, Variable Home Loan, Variable Home Loan Investment, Standard Variable Home Loan (Owner Occupied and Investment), Max Discounted Home Loan (Owner Occupied and Investment).

100% of deposit balance is offset against the balance of the linked home loan.