You might think the start of a new financial year is just for business owners and accountants – but it’s actually the perfect time for anyone to take stock and start fresh. After all, you don’t need a business to have financial goals. You just have to have a clear idea of what success looks like for you.

For some, it’s building an emergency fund. For others, it might be paying off your credit card, saving for a home renovation, or just feeling less stressed about rising costs. Whatever your version of financial success is, now’s the perfect time to define it – and make a plan to get there.

This guide walks you through practical, no-nonsense steps to help you understand your financial situation, set realistic goals and build habits that support the life you want – both now and in the long run.

Get the lay of the land

Before you can set new financial goals, you need to know where you’re starting from. That means taking an honest, judgement-free look at your current financial situation.

What’s coming in? What’s going out? (And yes, include the sneaky stuff – like those $7 coffees, late-night impulse buys or subscriptions you forgot you had.)

Start by writing down all your expenses – rent or mortgage repayments, utilities, groceries, child care fees, loan repayments, insurance, gym memberships, takeaway dinners – the lot. Then do the same for your income – your regular pay plus anything extra like bonuses, side hustles or Centrelink payments.

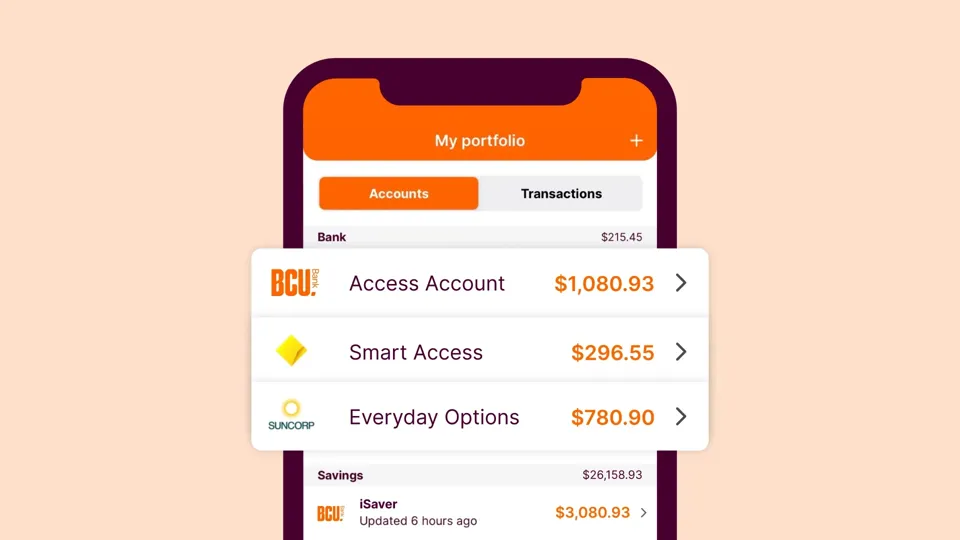

It doesn’t have to be fancy. You can use a spreadsheet, your phone’s notes app, or a budgeting tool like mymo by BCU, which pulls together all your accounts – even those from other banks – and automatically categorises your transactions, so you can track your spending in real time.

Once you’ve got the full picture, ask yourself: How much did I actually save this year? Am I spending more than I earn? Are there any areas where I consistently overspend?

Once you know where your money’s going, it’s much easier to start redirecting it toward the things that really matter to you.

Set your goals

Now that you’ve got a clear picture of where you stand, it’s time to map out where you want to go.

Start by asking yourself: What do I want my money to do for me – this year, and in the years to come?

Your goals might include:

- Short-term: Think 3-12 months – things like fixing the car, replacing a major appliance, clearing a credit card debt, or setting a Christmas savings target.

- Long-term: Think 1 year and beyond – saving for a home upgrade, boosting your super, planning for your child’s education, or even retiring comfortably.

To make those goals stick, use the SMART formula. Make your goals:

- Specific (e.g. Save $10,000 for a home extension)

- Measurable (Track progress each month)

- Achievable (Based on your income and expenses)

- Relevant (Tied to something meaningful for you)

- Time-bound (Give yourself a deadline)

Then write them down somewhere you’ll see them regularly, whether that’s in a journal, a sticky note on the fridge or your digital dashboard in mymo. You can even tag specific transactions in the app or create budgets by category to help you stay focused.

Build your budget (and actually stick to it)

Here’s where it all starts to come together. You’ve got your goals – now it’s time to give your money a plan.

A good budget isn’t about restriction. It’s about making your money work for you, not against you. It should reflect your income, your responsibilities and your goals.

Whether you use a classic Excel sheet or a tool like mymo, set up a structure that works with your pay cycle and lets you track categories like:

- Fixed (mortgage, car repayments, utilities)

- Flexible (groceries, transport, kids’ activities)

- Fun (eating out, hobbies, gifts)

Give yourself a buffer for the unexpected – and be realistic. If you know you’ve got a family birthday or school holidays coming up, plan for it.

And don’t forget – your budget isn’t set in stone. Review it regularly and adjust it when things change (because they will).

Tidy up your financial life

This is the life admin stuff we all tend to avoid – but Future You will be glad you tackled it.

Start with your super. When was the last time you logged in to check your balance? Are your contributions on track? Could you make extra contributions? If you’ve changed jobs or taken time off work, it’s worth reviewing whether your retirement plans still make sense.

Next, take a look at your insurance premiums. Are your cover levels still appropriate? Could you increase your excess and lower your monthly payments?

Haven’t got a will? Time to book that appointment and get it professionally written or updated.

And while you’re in admin mode, organise your tax paperwork. Don’t let those receipts pile up. A quick tidy-up now will make tax time much easier later.

Stick with it (and be kind to yourself)

Financial progress doesn’t happen overnight. It’s the result of consistent habits, small course corrections and realistic expectations.

So, make a habit of checking in. Once a month, sit down with your budget and your goals. What worked this month? What didn’t? Are you on track, or do you need to adjust?

Give yourself credit for the small wins – whether that’s saving an extra $200 this month, or cutting back on unnecessary purchases.

Finally, if you’re someone who loves a challenge, try setting yourself 10 financial goals at the start of the year and track how many you tick off by 30 June. You might not hit them all – but the momentum will take you further than you think.

Ready to take control of your finances?

The new financial year is the perfect time to get organised, set your goals and make your money work harder for you. Whether you’re planning for the next 12 months or the next 20 years, mymo by BCU can help you stay on track with customised budgeting tools, real-time tracking and clear insights across all your accounts.

Because success looks different for everyone. And your money should work the way you do.

You may also be interested in:

The 50/30/20 budgeting rule

The 50/30/20 budgeting rule is a great guide to help you plan how much of your salary you should be splitting up for needs, wants and savings.

Boss Saver

Mobile app

Important information

Banking and Credit products issued by Police & Nurses Limited (BCU Bank).

Any advice does not take into account your objectives, financial situation or needs. Read the relevant terms and conditions, before downloading apps or acquiring any product, in considering and deciding whether it is right for you. The Target Market Determinations (TMDs) are available on our website or upon request.