My oh mymo

mymo by BCU is your personal financial assistant, with all of your accounts across all your financial institutions in one place, and handy features aligned to make your money work for you.

Because as a customer-owned, customer first bank, we're is always working to enhance your experience – and mymo by BCU makes it easier than ever for you to navigate your financial future.

Getting started with mymo

BCU Bank customers have automatic access to our handy budgeting app – all you have to do is register!

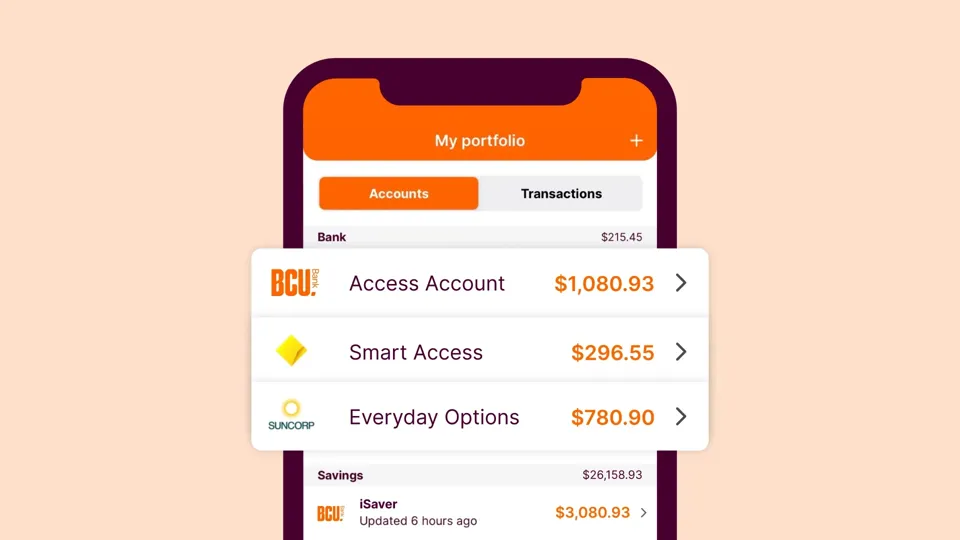

Because you want all your accounts in one place

- Securely add your transaction and savings accounts, credit cards, and home and personal loans from every Australian financial institution into mymo in just a few clicks, so you can see exactly where your money is going.

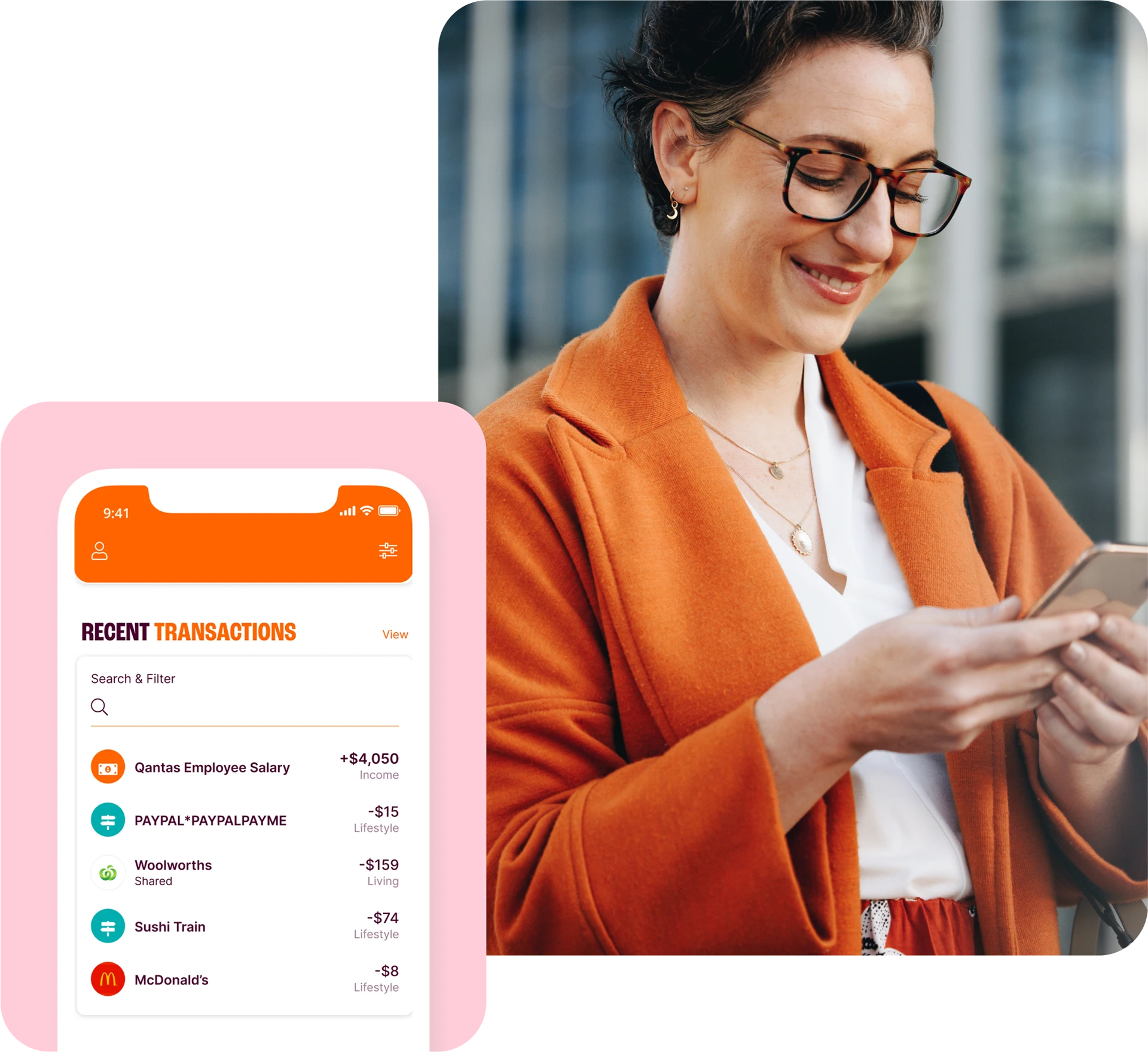

- All of your transactions across all of your accounts will be automatically categorised, so you can track your spending at a glance.

- Because it’s your money for you to use your way, you can personalise and update categories however you want to suit your needs and your lifestyle.

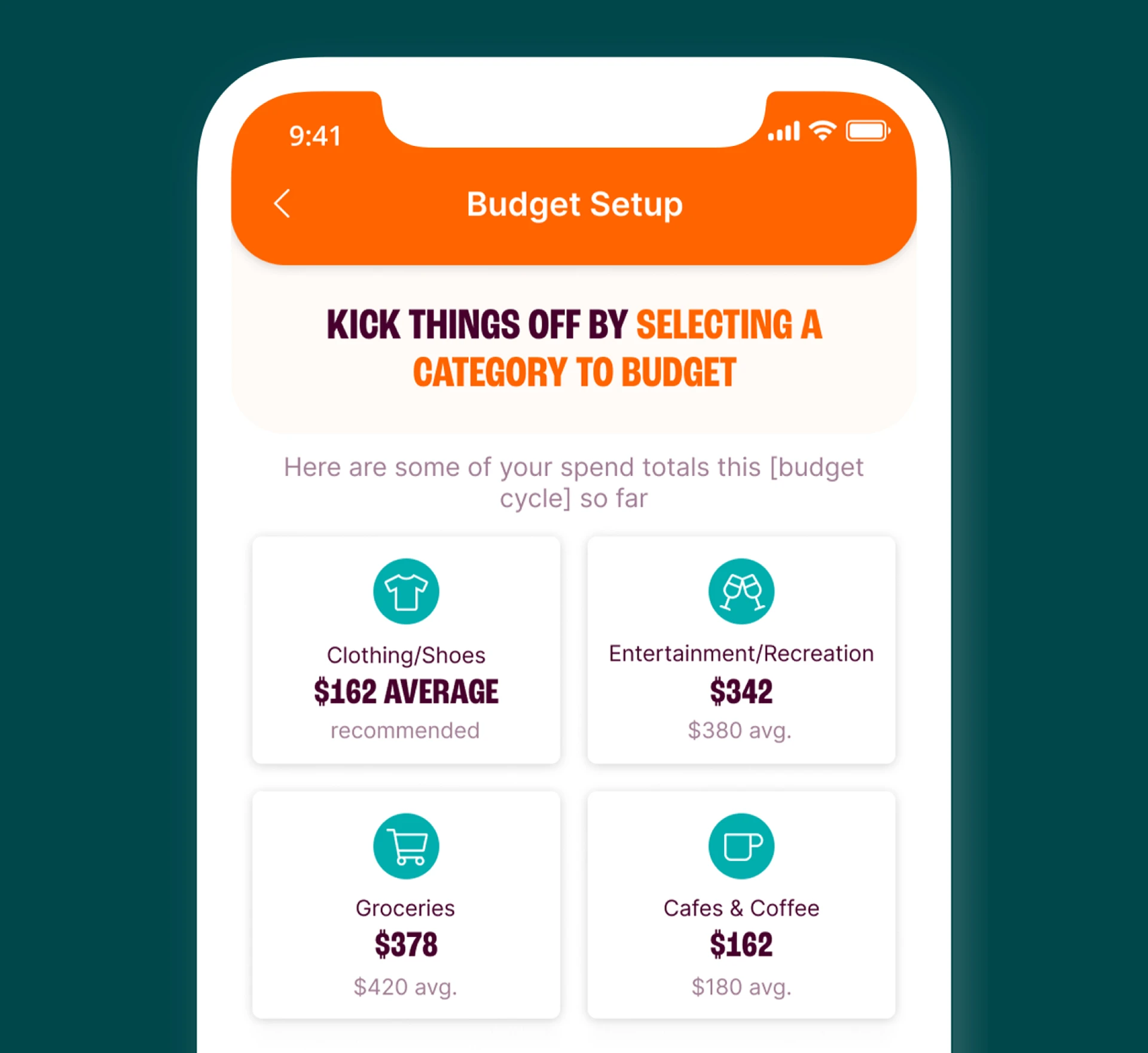

Because you want to reach your financial goals faster

- Set up a budget quickly and easily and match it to your pay cycle. We’ll keep an eye on it for you, making sure you stay on track.

- Keep an eye on your spending (and savings!) with every transaction, in real-time.

- Set budgets by category – whether it’s for business, for pleasure, or any other purpose you choose.

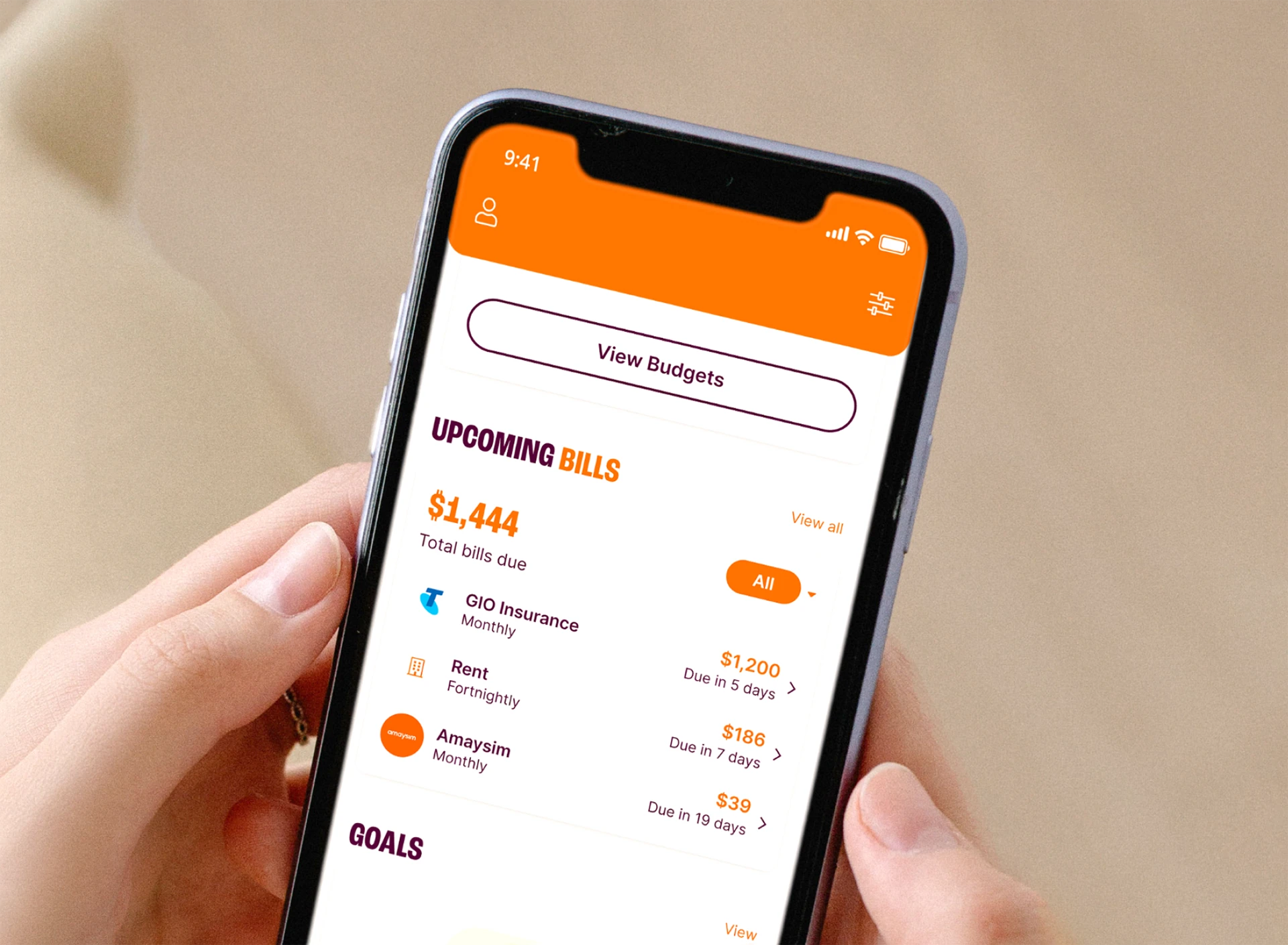

Because you don't like surprises

- Create a bill for any transaction in any account, and set the frequency so you know when to expect it in the future.

- mymo will let you know when bills are coming up and give you a heads-up in advance if there isn’t enough money in your account to cover them, so you can avoid any nasty surprises.

A tool you can trust

mymo is a the ultimate financial empowerment tool from the trusted team at BCU. It complements and sits alongside our existing suite of digital solutions that our members know and love, including the BCU Bank app.

mymo by BCU is an Open Banking solution developed under the Australian Government’s Consumer Data Right (CDR) scheme. We’re proud to support the Open Banking initiative, which gives you more control over your information and puts your data back in your hands.

Your data is safe, protected, and yours to use as you wish.

Because we're here to help

Got a question about our budgeting app?

Yes, you need to be a BCU Bank customer to use the mymo app – which can help you up your budgeting, money management, and savings game.

With so many great bank accounts, home loans, and insurance options, why wouldn’t you join our customer-owned bank? And opening an everyday or savings account online is quick and easy.

Find out how you can join BCU BankYour bank account data is securely stored and managed in line with CDR legislation rules and safeguards, just like your other banking apps.

BCU Bank is an Accredited Data Recipient (ADR), governed by the Australian Competition and Consumer Commission (ACCC). We're required to adequately protect your Consumer Data Right (CDR) information from misuse, interference, loss, and unauthorised access, modification, or disclosure – making it a safe and secure way to view and track your accounts all in one place.

Find out more about the Consumer Data Right

It's easy to edit the transaction details in mymo to ensure accuracy and that the correct category is being used.

Select the transaction you want to edit, or search for it using the search bar. You can edit all the details of every transaction, including the name and category.

You can also:

-

- add a tag for better organisation and searchability,

- exclude it from tracking so that certain transactions won't be included in budget calculations,

- add a note to a it, or

- create it as a recurring bill.

If a transaction is excluded from tracking (using the 'exclude from tracking' toggle), you have the option to select just one particular transaction or all current and future transactions.

You can also customise your dashboard by rearranging, adding, or removing widgets. Simply drag and drop the different elements up and down the list.

Important information

Banking and Credit products issued by Police & Nurses Limited (BCU Bank).

Any information on this website is general in nature and does not consider your personal needs, objectives or financial situation. Our rates are current as of today and can change at any time. Credit eligibility criteria, terms and conditions, fees and charges apply.

Read the relevant product terms and conditions before deciding if a product is right for you.