If you’ve ever looked at your bank balance and wondered where your money went, you’re not alone. With living costs climbing, it can feel like no matter how careful you are, your money just doesn’t stretch as far as it used to.

Enter: money management apps. Powered by Open Banking, these apps help you see the bigger picture of your finances so you can feel in control again. The best part? We’ve got our very own app, mymo by BCU, to help you achieve exactly that.

How does it work?

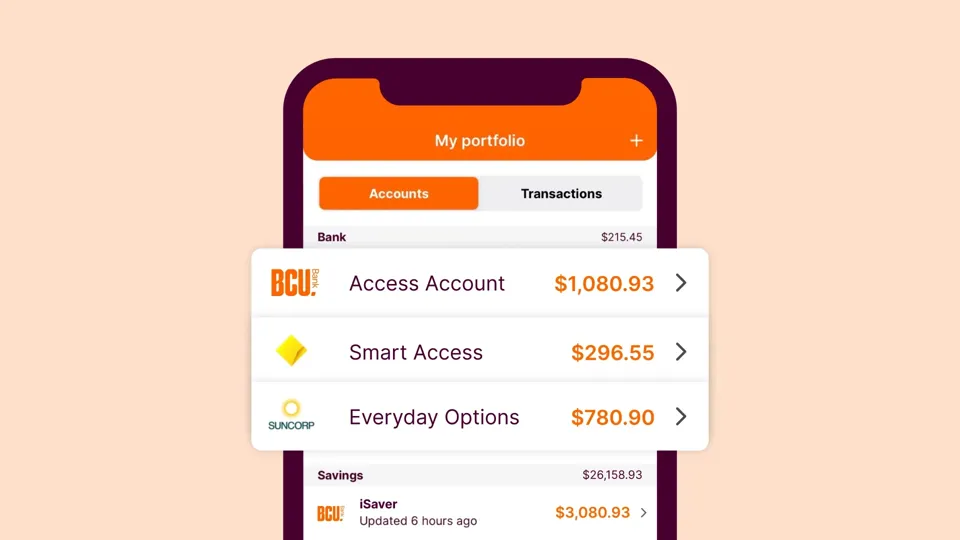

Open Banking is part of Australia’s Consumer Data Right (CDR). Put simply, it gives you the right to share your banking data safely with trusted apps like mymo. Instead of flicking between different banking apps, spreadsheets, or guesswork, mymo brings all your banking together in one secure dashboard.

If the idea of being able to see all your accounts in one place didn’t excite you enough, people using money management apps powered by Open Banking are saving an average of $330 every month (2025 State of Open Banking report, Frollo). That’s nearly $4,000 a year – enough to cover school fees, pay down debt, or save for something special.

How apps can help you to save more

When you connect your accounts to the app, you get a clear, up-to-date picture of your money across multiple banks, credit cards, and loans. That means you can:

- See everything in one place: All your accounts, spending, and savings are pulled into a single view.

- Track your habits: mymo shows where your money is going, so you can spot patterns you might otherwise miss.

- Make smarter choices: See your spending grouped into categories like groceries, entertainment and bills so you can cut back where it counts and save more.

Real savings, real people

The results speak for themselves. Since the launch of Open Banking, Australians have seen their average savings balances grow by more than 20% (2025 State of Open Banking report, Frollo). Don’t just take our word for it – one user told us that apps like this “helped me through some really tough times,” and made it possible to pay off a large credit card debt and put money aside for emergencies. Another shared that everyone should use a budgeting app as it helps to have a better understanding and control of their financial position.

Important information

Banking and Credit products issued by Police & Nurses Limited (BCU Bank).

Any advice does not take into account your objectives, financial situation or needs. Read the relevant terms and conditions, before downloading apps or acquiring any product, in considering and deciding whether it is right for you. The Target Market Determinations (TMDs) are available on our website or upon request.