Talking about money isn’t about bragging or measuring your worth by your bank balance. It’s not a competition over who’s got their finances all figured out, because honestly, most of us are still learning as we go. What it is about is creating space for honest, supportive conversations that can empower and bring us closer to the people around us.

Here are five solid reasons to start opening up about money with your friends:

1. It helps lift the weight of shame

Money worries can feel very personal and sometimes, really heavy. Whether you’re dealing with debt, unsure how to budget, or just feeling behind, it’s easy to think you’re the only one. But keeping quiet only adds to the stress. Being honest about where you’re at financially can be incredibly freeing. More often than not, you’ll discover that others have gone through similar experiences, and that shared understanding can be both comforting and motivating.

2. We grow by sharing what we know

Everyone’s money journey looks different. Some people picked up financial smarts from family members, others learned by trial and error. You might know someone who’s great at saving, investing or spotting the best deals, and chances are, you’ve got something valuable to share too.

Trading money tips and stories with friends turns personal finance into a team effort. Think of it as building your own money-savvy community.

Want to level up your learning? Give Your Financial Wellness a try! It’s a free online tool that tests your financial literacy and provides interactive learning modules to suit your needs.

3. It keeps us on track

Have a money goal in mind? Whether you’re saving for an international holiday, cutting back on spending, or trying to pay off a loan, telling someone about it can help. Just having a mate check in now and then can make a huge difference. And let’s face it – when you know someone else is cheering you on (and maybe keeping you honest), you’re more likely to stick at it and reach your goal.

4. It makes socialising fairer for everyone

Group dinners, birthday gifts, weekend getaways… It all adds up! And if no one talks openly about budgets, some of your friends might feel pressured to spend more than they can afford. By being transparent about money boundaries, you and your mates can find ways to hang out that work for everyone with no guilt or awkwardness and just mutual respect.

5. It challenges outdated taboos

For a long time, money has been a ‘no-go’ topic in many social circles. But staying silent often keeps people stuck. When we start talking honestly and respectfully about money, we help normalise it. That shift creates a culture where people feel safe to ask questions, seek support, and make informed choices.

Let’s start a conversation

Being open about money isn’t about oversharing or judging. It’s about creating a space where honesty leads to growth. From reducing shame to learning from each other, the benefits are real.

So, the next time money and finances come up in conversation, don’t brush it off. Lean in. You never know whose perspective you’ll change, or how it might shift your own money outlook for the better.

Important information

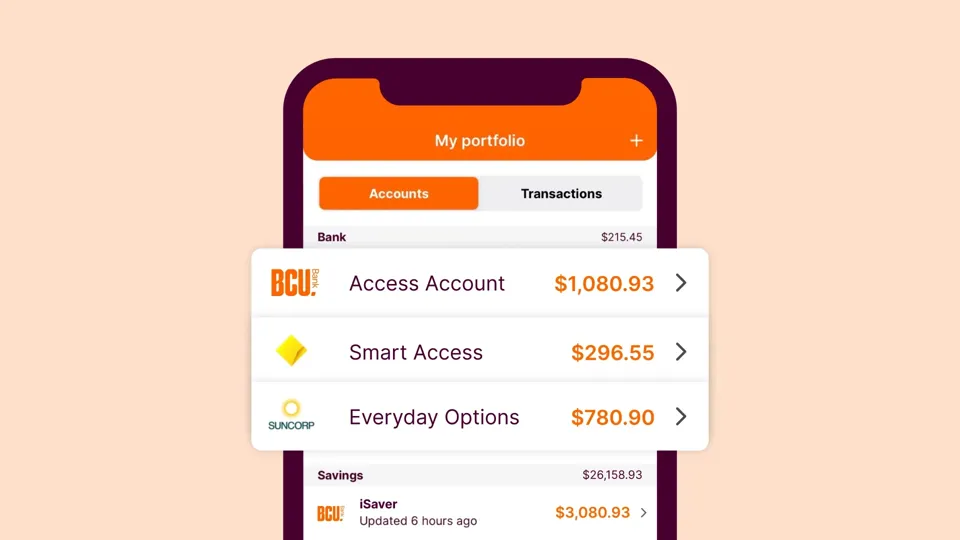

Banking and Credit products issued by Police & Nurses Limited (BCU Bank).

Any advice does not take into account your objectives, financial situation or needs. Read the relevant terms and conditions, before downloading apps or acquiring any product, in considering and deciding whether it is right for you. The Target Market Determinations (TMDs) are available on our website or upon request.