With the cost of living continuing to rise, being disciplined about your budgeting habits can help reduce overspending and keep regular costs to a minimum. Reviewing your budget monthly might seem like a chore, but it can be a quick way to keep your spending in check.

Ask yourself these questions at the end of each month to see if there are new opportunities to reduce your expenses.

Am I paying too much in fees or fines?

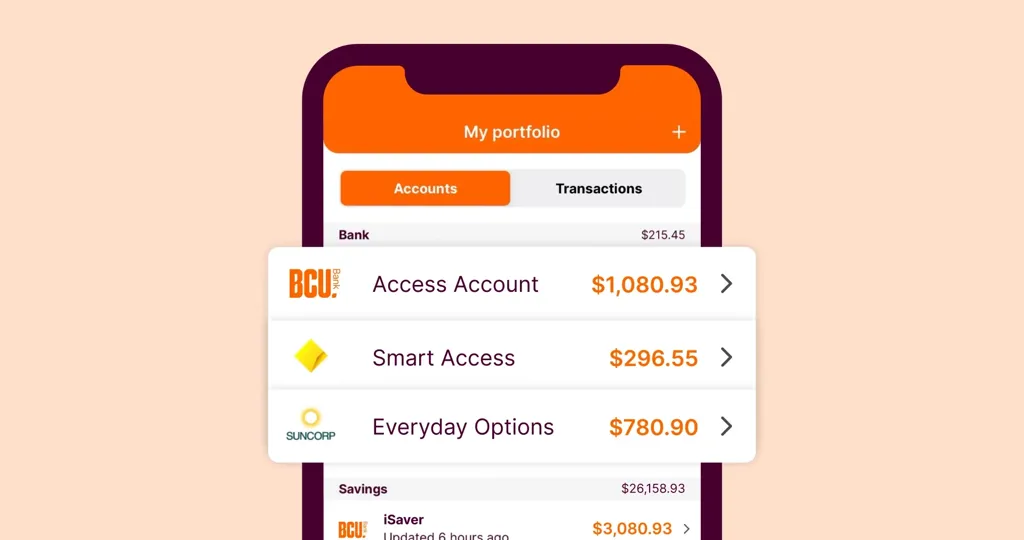

From late payment fees to overdrawn account fees, these charges often feel avoidable. In some cases, all it takes is a couple of reminders to make sure you pay a bill on time or have enough in your account for a direct debit. As soon as you receive a bill, pop a reminder in your phone’s calendar app so you remember when it’s due. mymo by BCU app users can use the bill reminder function to get a notification the day before your bills or direct debits are due so you can make sure there’s enough money in your account and avoid extra fees.

Am I using those memberships?

From gyms to professional associations, many of us have several memberships under our belts.

If you’re using the membership, it may represent good value for money; however, if it’s something you barely notice or remember, consider scrapping it. Check for any early exit or cancellation fees and minimum notice periods. If you can’t face the cold winter mornings but know you’ll hit the gym when the weather heats up, see if you can put your membership on hold for a bit until you get your mojo back.

How do I get from A to B?

Transport can be a major cost, particularly if it involves a car. Reviewing the monthly cost of getting around can be a good way to work out if you’re spending more than you’d like – especially with high petrol costs. Check out apps like MotorMouth or PetrolSpy to find the cheapest fuel near you. If you’re still spending a fair bit, it could be worth considering alternatives like carpooling, public transport, cycling, or walking.

Can I cut back on food and drink expenses?

If you use mymo by BCU, take a look at the ‘Restaurants’ and ‘Takeaway & snacks’ budget categories. If the amount you’ve spent makes you want to scream into a pillow, then it’s time to cut back. Consider setting a strict budget for non-grocery food items or commit to no food delivery apps to avoid inflated prices and delivery charges.

What’s one thing that doesn’t need to be there?

Whether it’s your Friday ritual of a choccie and a can of Coke at the servo on your way home from work, or treating yourself to getting your nails done, there may be certain transactions on your banking statement that can easily be avoided. These costs are often ‘wants’, rather than ‘needs’.

Each month, look for one cost that could be avoided the next month and set a goal either to remove or reduce it. Even though it’s only one thing, that cost could add up over the course of a year.

mymo by BCU can make it easier to find hidden ways to save.

Important information

Banking and Credit products issued by Police & Nurses Limited (BCU Bank).

Any advice does not take into account your objectives, financial situation or needs. Read the relevant terms and conditions, before downloading apps or acquiring any product, in considering and deciding whether it is right for you. The Target Market Determinations (TMDs) are available on our website or upon request.