Why choose a Cash Passport?

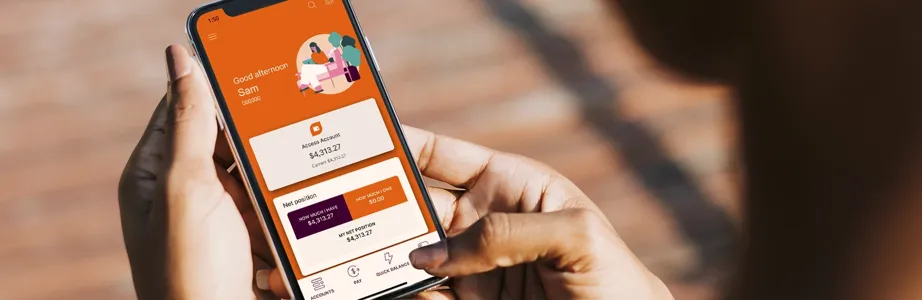

Your trusted, prepaid, travel card

A Mastercard Cash Passport™ is your ultimate travel buddy. You can load up to 11 currencies on one card, and spend wherever Mastercard is acceped worldwide^ – in shops, online, or at ATMs.

How does a Cash Passport outsmart travel money?

Ready to go?

Visit the Cash Passport website to order a new Cash Passport or top up your current card.

Important information

Mastercard Prepaid Management Services Australia Pty Ltd (ABN 47 145 452 044, AFSL 386 837) arranges for the issue of the Cash Passport™ Platinum Mastercard® (“Cash Passport”) in conjunction with the issuer, EML Payment Solutions Limited (“EML”) (ABN 30 131 436 532, AFSL 404131). You should consider the Product Disclosure Statement for the Cash Passport available at www.cashpassport.com.au before deciding to acquire the product. Any advice does not take into account your personal needs, financial circumstances or objectives and you should consider if it is appropriate for you. The Target Market Determination for this product can be located at www.cashpassport.com.au. Mastercard and the circles design are registered trademarks of Mastercard International Incorporated.

* Lock-in your exchange rates means the exchange rate is locked in for the initial load only. The exchange rates for subsequent reloads will be set at the prevailing exchange rate at the time of the transaction.

^ Subject to any surcharge that may be imposed directly by merchants. Cash Passport is unable to be used for purchases related to gambling or adult entertainment. Currently Cash Passport cannot be used in the following countries and geographical regions due to sanctions that are currently in place: Crimea, Iran, North Korea, Sudan, Syria, Donetsk and Luhansk. If you attempt to use your card at merchants in any of these countries and geographical regions, your request will be declined. Additionally, all Mastercard will not work at Russian merchants or ATMs. In addition, the ATMs and POS terminals are not owned or operated by the Issuer or Mastercard Prepaid Management Services Australia Pty Limited and the Issuer or Mastercard Prepaid Management Services Australia Pty Limited are not responsible for ensuring that merchants will accept the Card. For example, the Issuer and Mastercard Prepaid Management Services Australia Pty Limited cannot control when an ATM or POS terminal is due for maintenance or is faulty or if a merchant chooses not to accept the Card. In such cases, your Card may not function properly or be declined. For more information please see the Product Disclosure Statement at www.cashpassport.com.au for the Target Market Determination.

† Before you make a decision to acquire the card, please check www.cashpassport.com.au for the latest currencies supported.

# T&Cs apply. Customer must contact Customer service to report lost or stolen card. Emergency cash can be arranged up to the balance on your Cash Passport, subject to availability of funds at the approved agent location. Please visit www.cashpassport.com.au for contact details.

+ Flight Delay Pass is provided to you on the basis you are not in breach of Cash Passport MasterCard® Product Disclosure Statement and Terms & Conditions and your card remains open. It must not be sold in any way and Mastercard reserves the right to cancel the pass that are in breach of this policy. Access may not be available if the applicable lounge is full or near capacity at the full discretion of lounge staff. Access and use of the lounges is subject to its own terms and conditions. Mastercard reserves its right to amend or withdraw the Flight Delay Pass at any time and where possible, provide prior notice to you. Visit the Flight Delay Pass website for Terms and Conditions.

** Purchase Protection, Price Protection and E-Commerce Purchase Protection is provided under a group policy issued by AIG Australia Ltd (ABN 93 004 727 753, AFSL 381 686) (AIG) to Mastercard Asia/Pacific Pte. Ltd. Cover is available to Cash Passport Platinum Mastercard Cardholders (Eligible Person). Eligible Persons can claim under the Group Policy as third-party beneficiaries in accordance with section 48 of the Insurance Contracts Act 1984 (Cth). If an Eligible Person wishes to claim, such claim will be subject to the eligibility criteria, terms, conditions, exclusions, limits and applicable sub-limits as further detailed in the terms and conditions for such coverage found at Cash Passport Platinum Mastercard Complimentary Insurance Terms and Conditions. In arranging these Insurances Mastercard Asia/Pacific Pte. Ltd. is acting as a group purchasing body under ASIC Corporations (Group Purchasing Bodies) Instrument 2018/751.