Because we're here to help

You might also be interested in

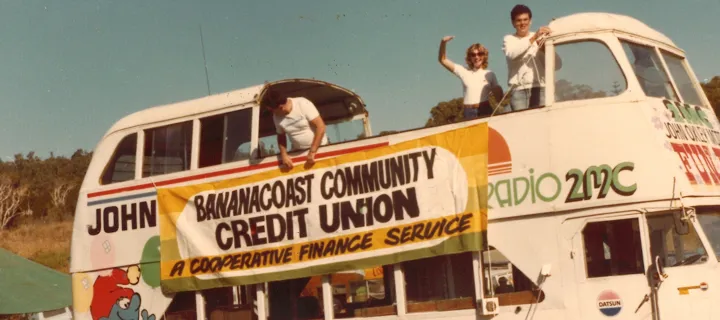

About BCU Bank

BCU Bank is a division of Police & Nurses Limited and provide a local, realistic banking alternative to the big banks, built on a foundation of trust and reliability.

Community

As a customer-owned organisation, we’re passionate about supporting our communities and giving back.

News and media

The latest BCU Bank news and media releases, such as award wins, topical updates, community initiatives, executive appointments, financial results, and more.