Live your best life with mymo by BCU

Ready to set up mymo and make the most of your money? If you’re new to BCU Bank, your first step is to open a bank account with us. This can be done completely online, and only takes a few minutes.

You'll need to:

Make a date with mymo

They say good things take time, and getting serious about your finances is no different. So grab a coffee or glass of wine and prepare to spend a good 30 minutes getting intimate with your money.

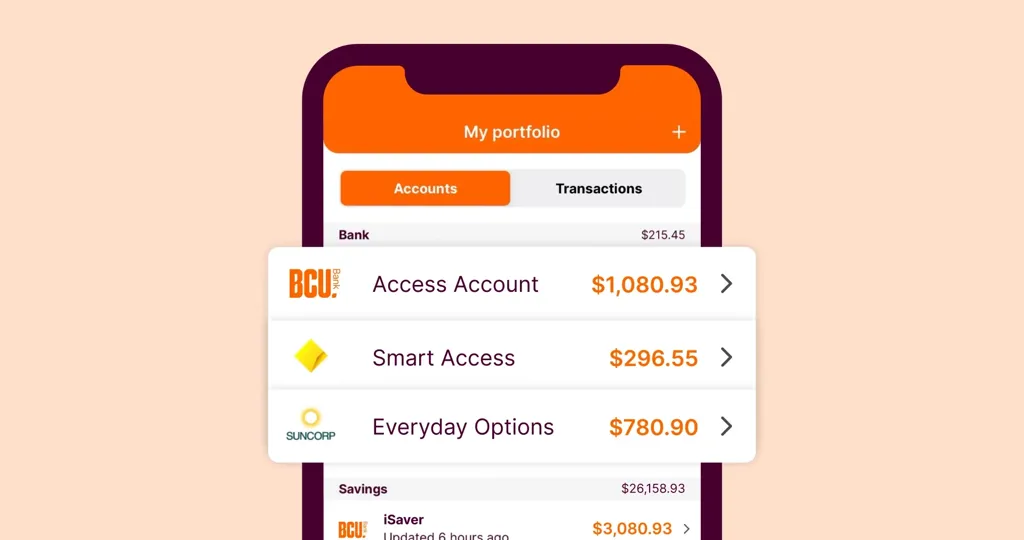

Follow the prompts in the mymo app to add your other bank accounts, add goals, create a budget, flag upcoming bills, and so much more – it’s managing your money, your way.

Then, once you’re set up, prepare to budget like a boss in as little as two minutes per day and get closer to reaching your money goals.

Because we're here to help

Important information

Banking and Credit products issued by Police & Nurses Limited (BCU Bank).

Any information on this website is general in nature and does not consider your personal needs, objectives or financial situation. Our rates are current as of today and can change at any time. Credit eligibility criteria, terms and conditions, fees and charges apply.

Read the relevant product terms and conditions before deciding if a product is right for you.