About BCU Bank

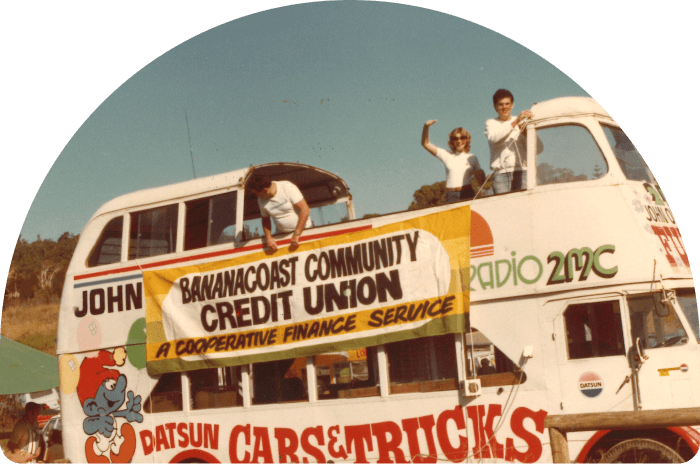

BCU Bank is a division of Police & Nurses Limited following the successful merger between Bananacoast Community Credit Union Ltd and Police & Nurses Limited. BCU was originally created in the early 1970’s, formed by a small group of business owners - predominately banana farmers on the NSW North Coast - to provide a local, realistic banking alternative to the big banks.

Then and now

Fast forward nearly 50 years and the BCU brand continues to offer localised service and expertise from Port Macquarie to the Sunshine Coast whilst enjoying the economies of scale that comes from being part of the larger member owned Police & Nurses Limited. Find out more about our history.

It's about our members

Members have been an integral part of the development and growth of BCU from its inception and they are proud to have helped shape this journey. They share BCU's passion for our regions and respect the commitment BCU have to helping the local communities to thrive.

We value our staff

At BCU Bank, our staff are our biggest asset. We have a dedicated and passionate team of people who are committed to delivering genuine personal service; and creating deep and enduring customer relationships, built on a foundation of trust and reliability.

Award winning

BCU Bank has been the recipient of many prestigious awards in the last few years, highlighting our dedication to keeping our products relevant, our fees fair, and offering our Members the little extras that many of our competitors don’t. We are extremely proud to remain committed to the original purpose of the founders of BCU and provide a genuine banking alternative.

A few key milestones along the way

1970

Nambucca Banana Growers' Federation Members Credit Union is formed.

1974

The first full-time office opens in Coffs Harbour. Name changes to Bananacoast Community Credit Union Ltd.

1982

BCU becomes computerised and approaches $5 million in assets.

1996

ATMs are installed at Nambucca Heads and Macksville.

2001

BPAY and online banking is introduced.

2007

BCU launches Classic and Bonus Rewarder Visa Credit cards.

2012

BCU opens its 23rd branch.

2012

Flagship branch opening - centre of excellence and innovation.

2015

Membership growth to 50,000.

2016

Money Magazine's Credit Union of the Year.

2017

Multi-Award winning products, recognised by Mozo, Canstar, and Money Magazine.

2018

New Coffs Harbour office opened.

2019

Successful merger with WA's largest community owned bank to become one of the strongest member owned organisations in Australia.

2020

BCU celebrates its 50 year anniversary with the launch of the Bill Ussher community programs.